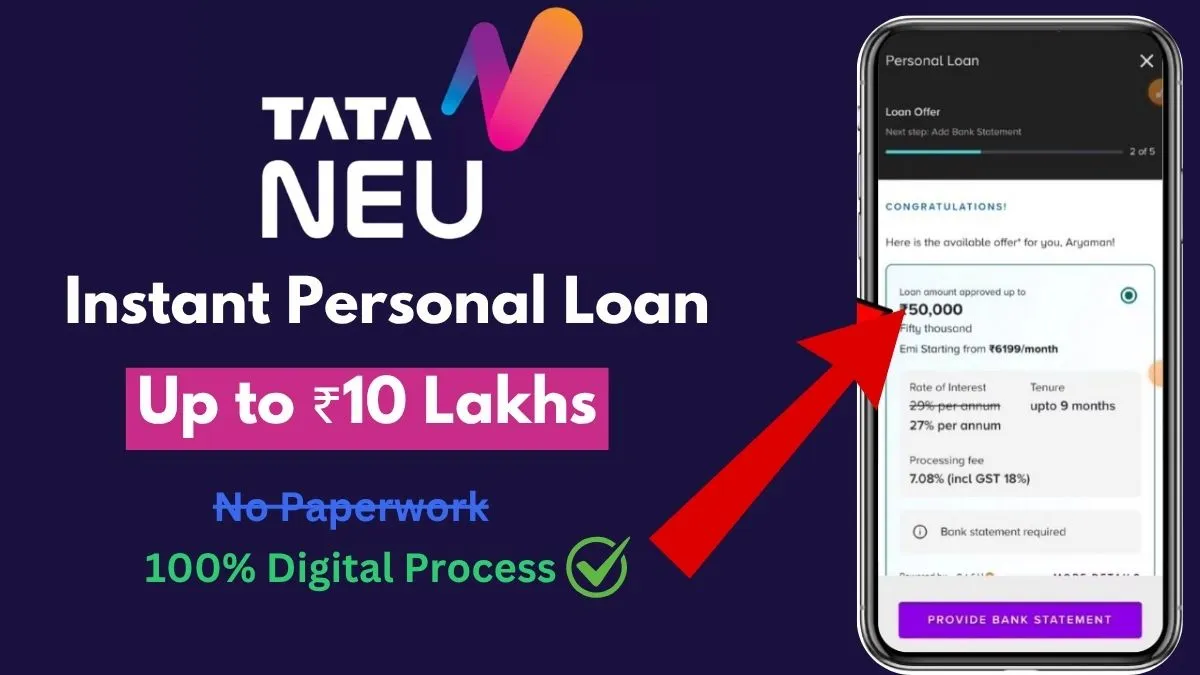

Tata NEU Instant Personal Loan App 2025: Personal Loans have become a significant financial solution for many individuals. If you’re required an emergency personal loan up to 10 Lakhs then the Tata NEU Instant Personal Loan stands out for its seamless application process and attractive interest rates.

In this article, you’ll get detailed information on the Tata NEU Instant Personal Loan, including its features, eligibility criteria, required documents, application process, interest rates, and a conclusion to help you make an informed decision.

Contents

Overview of Tata NEU Instant Personal Loan

Tata NEU offers an instant personal loan designed to meet consumers’ diverse financial needs. Whether you need funds for medical emergencies, travel, home renovations, or any urgent personal requirements, the Tata NEU Instant Personal Loan provides an accessible and hassle-free solution.

| Loan App Name | Kissht |

|---|---|

| Category | Instant Loan App |

| Loan Type | Personal Loan |

| Loan Amount | Up to ₹10 Lakhs |

| Process | 100% Digital |

| Repayment Tenure | Up to 60 Months |

| Required Credit Score | 550-700 |

| Approval Type | Instant |

| Interest Rate | Starting from 10.49% p.a. |

| Disbursal Time | 10 Minutes |

| Required Documents | PAN, Aadhaar, Selfie, Bank Statement (if requested) |

| App Link | Download |

Similar Loan Apps

Eligibility Criteria

- Age: 21 to 58 years.

- Income: Minimum monthly income of ₹25,000.

- Employment: Salaried individuals must be employed with a reputed organization, and self-employed individuals should have a stable income.

- Credit Score: A good credit score (above 650) is preferable.

Required Documents

When applying for the Personal Loan on the Tata NEU App, you’ll need to submit the following documents:

- Aadhaar card, voter ID, or any government-issued ID.

- Any government-issued document with your address.

- Income Proof

- Passport-sized photographs.

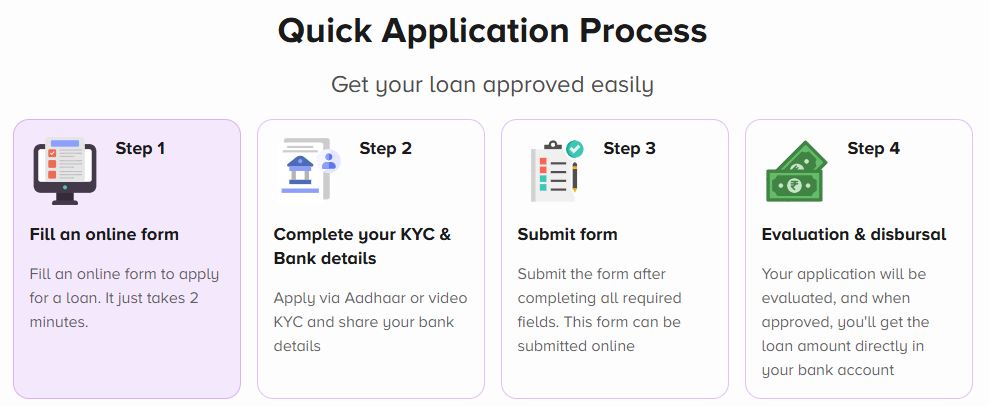

How to Apply for Tata NEU Instant Personal Loan?

- Download the Tata NEU App: Available on both iOS and Android platforms.

- Sign Up or Log In: Create an account or log into your existing Tata account.

- Select Loan Option: Navigate to the personal loan section and click on ‘Apply Now.’

- Fill in Personal Details: Enter your name, contact information, income details, and the required loan amount.

- Upload Documents: Submit the necessary documents as per the requirements.

- Submit Application: Review your application and submit it for processing.

- Loan Approval: Upon approval, the loan amount will be disbursed to your bank account shortly.

Interest Rates & Charges

The interest rates on the Loan typically range from 10.49% to 21% per annum, depending on factors like eligibility, credit score, and loan amount. Additional charges may include:

- Processing Fee: Up to 2.5% of the approved loan amount.

- Late EMI Charges: Paying back your EMI dues on time is very important. Failing to pay back dues on time shall levy charges, impact your credit rating & you may face difficulties to avail credit in future. Charges shall be applicable as per lender policy.

Conclusion

The Tata NEU Instant Personal Loan is an excellent financial product for anyone in need of quick funding. With competitive interest rates, flexible repayment options, and a straightforward application process, it is designed to cater to various personal finance requirements. However, it’s essential to assess your financial situation and repayment capacity before applying.

Disclaimer: This article serves as a guide for informational purposes only. The details provided here are subject to change based on Tata NEU’s policies and should be verified through official sources. Always read the terms and conditions carefully before applying for any financial product.