| App Name | LazyPay |

| Loan Type | Instant Personal Loan |

| Loan Amount | Up to ₹5 Lakh |

| Interest Rate | Up to 32% PA |

| Repayment Tenure | 3 to 24 months |

| Verification Type | Online Digital Process |

| Review | 4.4 Star |

| Official website | lazypay.in |

LazyPay App Instant Personal loan: The LazyPay is one of India’s most convenient and fastest-growing digital lending platforms. Known for its “Buy Now, Pay Later” services, but now it has expanded its offerings to include instant personal loans of up to ₹5,00,000, making it a go-to solution for users who need quick access to funds without lengthy paperwork or long wait times.

LazyPay is a top-rated instant personal loan app with 1+ crore downloads on the Google Play Store and a 4.4-star rating. Need urgent funds? Install the LazyPay App now and get an instant Personal loan of up to ₹5 lakhs with a 100% digital process. With fast approval and flexible repayment, LazyPay makes borrowing simple.

Contents

LazyPay App Instant Personal loan

LazyPay is a BNPL (Buy Now, Pay Later) and instant loan app that provides:

✅ Quick loans: ₹1,000 – ₹5 lakhs

✅ Fast approval: Disbursal in 10 minutes – 24 hours

✅ Flexible tenure: 3–36 months

✅ No collateral: Unsecured loans for salaried & self-employed

Best for: Urgent expenses, online shopping, or bill payments.

Eligibility Criteria

To qualify, you need:

✔ Age: 21–60 years

✔ Income: ₹15,000+ monthly (salaried/self-employed)

✔ Credit Score: 650+ (relaxed for first-time users)

✔ Documents: PAN, Aadhaar, Bank statements

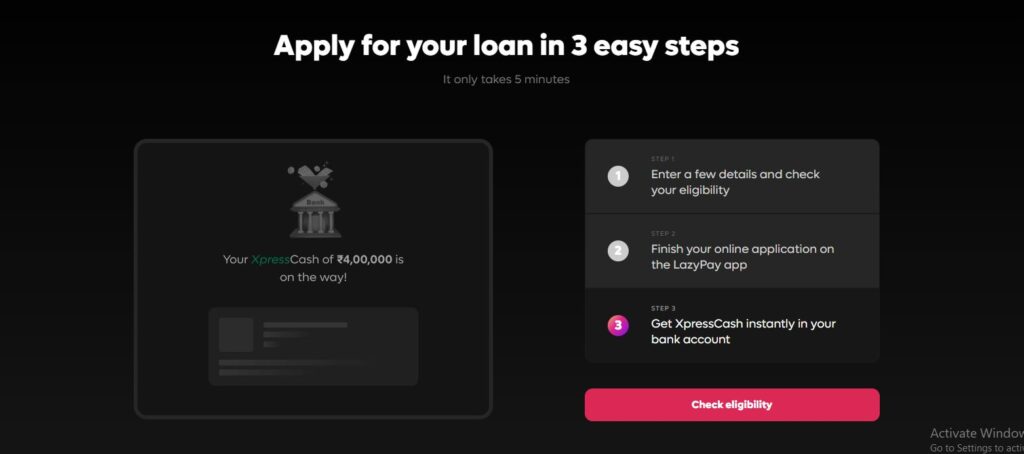

How to Apply Personal Loan from LazyPay?

Step 1: Download the App

- Install LazyPay from the Google Play Store.

- Register with your mobile number.

Step 2: Complete KYC

- Upload PAN & Aadhaar (e-KYC verification).

- Enter employment & bank details.

Step 3: Select Loan Amount

- Choose amount (₹3K–₹5L) & tenure (3–36 months).

- Check EMI breakdown.

Step 4: Receive Funds

- Approval in 10 minutes – 24 hours.

- Amount credited to your bank account directly.

Similar Loan App:

LazyPay Interest Rates & Charges

- Interest: 1.5%–2.5% per month (18%–30% p.a.)

- Processing Fee: 0%–3% (depends on profile)

- Late Fee: 2% per day (on overdue EMIs)

- Prepayment: 0%–3% charges

Pros & Cons of LazyPay App Instant Personal loan

| ✅ Advantages | ❌ Disadvantages |

|---|---|

| ✔ Instant disbursal (as fast as 10 minutes) | ❌ High interest rates (up to 30% p.a.) |

| ✔ No collateral or guarantor needed | ❌ Short max tenure (36 months) |

| ✔ Flexible repayment (up to 36 months) | ❌ Limited to pre-approved users |

| ✔ Low CIBIL impact (soft credit check) |

LazyPay Customer Care

- Email: support@lazypay.in

- Phone: 02269821111 (MON to SUN 10 AM to 7 PM).

- App Chat: 24/7 support

Final Verdict

LazyPay is ideal for quick, small-ticket loans and shopping EMIs due to its instant approval. However, the high interest rates make it costly for long-term borrowing. In 2025, LazyPay has proven itself as a fast, reliable, and easy-to-use personal loan app that supports the financial needs of India’s young population. Whether you’re facing a mid-month cash crunch or planning a short trip, LazyPay’s instant loan of up to ₹5 lakhs is a trustworthy option.

👉 Download the app, check your eligibility, and get your loan disbursed within hours!