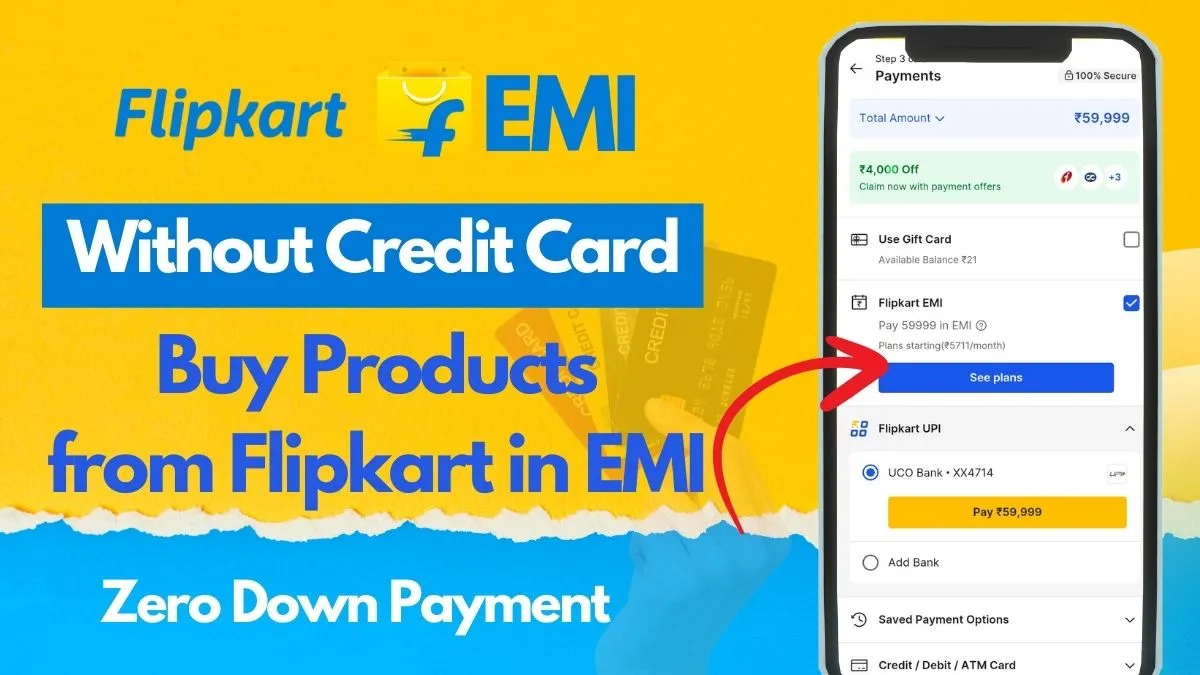

Flipkart EMI 2025: Without Credit Card, Purchase in Easy Monthly Installments (EMI): Looking to buy big-ticket products like smartphones, laptops, TVs, fridges, or ACs in EMI but don’t have a credit card? Don’t worry! With Flipkart EMI, you can purchase high-value items and pay in easy monthly installments.

Flipkart has introduced the Flipkart EMI Payment option, previously known as Flipkart Pay Later. This feature allows you to purchase premium products today and pay in easy monthly installments with a tenure of 3 to 24 months. If you don’t have a credit card but want to buy products from Flipkart in EMI, sign up for Flipkart EMI today and split your purchases into easy monthly payments (sometimes even no-cost EMI deals).

Contents

Flipkart EMI 2025

Flipkart EMI is a payment mode available on the Flipkart App that allows you to shop now and repay your purchases through hassle-free, easy monthly installments with fixed tenures of either 3 months, 6 months, 9 months, or 12 months. Apply now and get up to a 1 Lakh Flipkart EMI Credit Limit.

| Flipkart EMI | Information |

|---|---|

| Credit Limit | Up to 1 Lakh |

| Lending Partner | IDFC First Bank |

| EMI tenures | Up to 12 Month |

| Minimum Order Value | ₹3000 |

| No Cost EMI | Available |

| Flipkart App | Download |

Benefits of Flipkart EMI

Flipkart EMI offers several advantages that make shopping easier. Here’s a look at the key benefits:

✅ Simple & Fast Checkout – Enjoy a seamless payment process.

✅ Zero Down Payment – Buy what you need now and pay in easy installments with flexible options.

✅ Transparent Billing – No hidden charges, just clear payment details.

✅ Instant Refunds – Get quick refunds on cancellations or returns.

✅ No-Cost EMI – Enjoy interest-free EMI offers from brands/sellers.

✅ Improve Credit Score – Timely repayments boost your credit history.

How to Activate Flipkart EMI Account?

The Flipkart EMI facility is currently available only to selected customers and applies to eligible products with a minimum purchase of ₹3,000. Follow the steps below to check eligibility and activate your Flipkart EMI Account now.

Step #1: Install the Flipkart App from the Google Play Store or Apple App Store.

Step #2: If already installed, open the app.

Step #3: Log in or sign up for your Flipkart account.

Step #4: Go to the Account Section and find the “Flipkart EMI” option under Credit Options.

Step #5: Click the “Activate” button and enter your PAN and Aadhaar card details.

Step #6: Verify your Aadhaar with OTP and link your bank account.

Step #7: Complete the KYC process and wait for confirmation.

Step #8: If approved by the lending partner, your account will be activated, allowing you to shop on Flipkart with easy monthly installment options.

How to Check Flipkart EMI Product Eligibility?

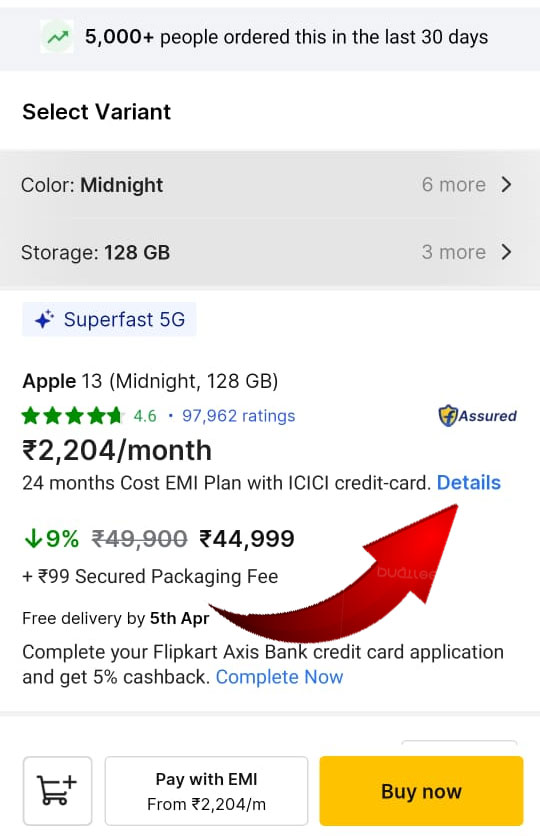

- Visit the product page on Flipkart.

- Look for the “EMI Options” section under the price.

- Here, you’ll see the “Flipkart EMI” option. If it’s not visible, the product isn’t eligible.

How can I place an order using Flipkart (EMI) on Flipkart?

- Add item(s) to your cart as usual

- Proceed to checkout

- Select Flipkart EMI as your payment mode, and select an EMI plan as per your preference.

Please note, you may need an OTP to complete your transaction. This is an additional verification required as an enhanced security measure for certain transactions only.

Flipkart EMI Calculator

Flipkart EMI Calculator

Calculate your monthly EMI payments for Flipkart purchases

- 2 Months – 1.25% + GST

- 3 Months – 1.25% + GST

- 6 Months – 1.5% + GST

- 9 Months – 2% + GST

- 12 Months – 2% + GST

| Payment # | Due Date | EMI Amount | Principal | Interest | Balance |

|---|

Eligibility

This EMI facility is currently available to only a select set of customers. To get Flipkart EMI Account approval, you need to meet certain eligibility criteria. While Flipkart and its lending partner, IDFC First Bank, haven’t officially shared specific requirements, here are some common factors to keep in mind:

- You should be a good customer of Flipkart.

- You should have an average credit history.

Flipkart EMI Rules

- Select your preferred EMI option at the time of payment.

- Final EMI is calculated on the total value of your order at the time of payment.

- The Bank charges annual interest rates according to the reducing monthly balance. In the monthly reducing cycle, the principal is reduced with every EMI and the interest is calculated on the outstanding balance.

- The minimum order value to avail the EMI payment option is Rs. 2,500

- This option is available only when the cart contains items from a single seller

- In case of any kind of refund in an EMI transaction, interest already billed in a particular transaction is not refundable under any circumstances.

- While you will not be charged a processing fee for availing Flipkart EMI option, the interest charged by the bank shall not be refunded by Flipkart.

- You may check with the respective bank/issuer on how a cancellation, refund or pre-closure could affect the EMI terms and what interest charges would be levied on you for the same.

- Processing fee if any will be charged by your card issuing Bank. Please check the Terms & conditions of availing EMI with your Bank

- For select banks, the interest amount on the first EMI will be calculated from the loan booking date till the payment due date.

- GST may also be levied by the bank as applicable.

Flipkart EMI not working

The Flipkart EMI facility is currently not available to all users. If you don’t see the option in your account’s Credit section, this service may not be accessible to you at this time.

For existing customers who can no longer use the service, here are possible reasons:

1️⃣ Expired KYC: Check your KYC status in the Flipkart EMI section under ‘Accounts’. Update if expired.

2️⃣ Overdue Payments: Your access may be restricted for Missed payments or Made repayments 30+ days past the due date.

3️⃣ Violation of Terms: Breach of Flipkart Advanz or lending partner’s T&C.

4️⃣ Policy Changes: Updates in Flipkart or lending partner’s internal policies.

Flipkart EMI Dedication date

The total amount due will be calculated on the 1st of the following month and must be paid by the 5th of the same month. You’ll receive email/SMS/app notifications with the due amount and a payment link on the 1st of each month. The payment deadline is the 5th of the month.

Customer Care Number

You can contact IDFC FIRST Bank at the following touchpoints:

- Phone: 1800 10 888 (customer care)

- E-mail: banker@idfcfirstbank.com

- Nodal Desk No & Email ID: 022-41652700 / nodaldesk@idfcfirstbank.com

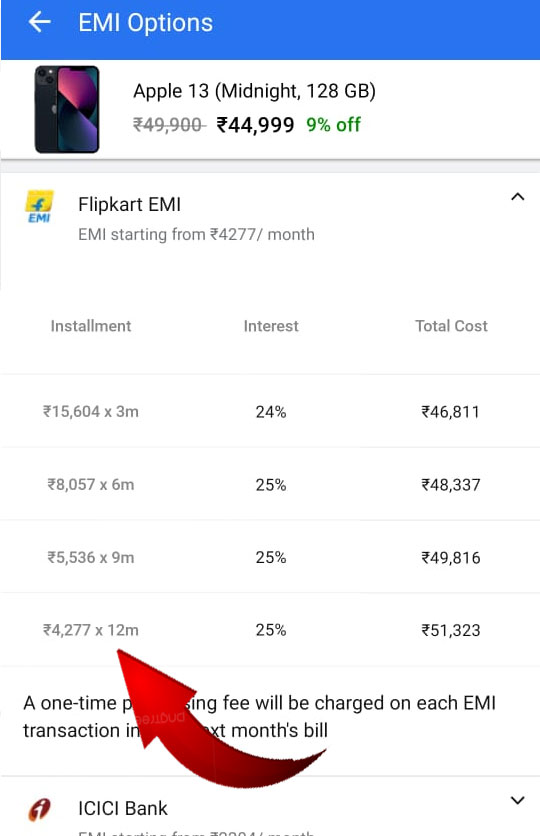

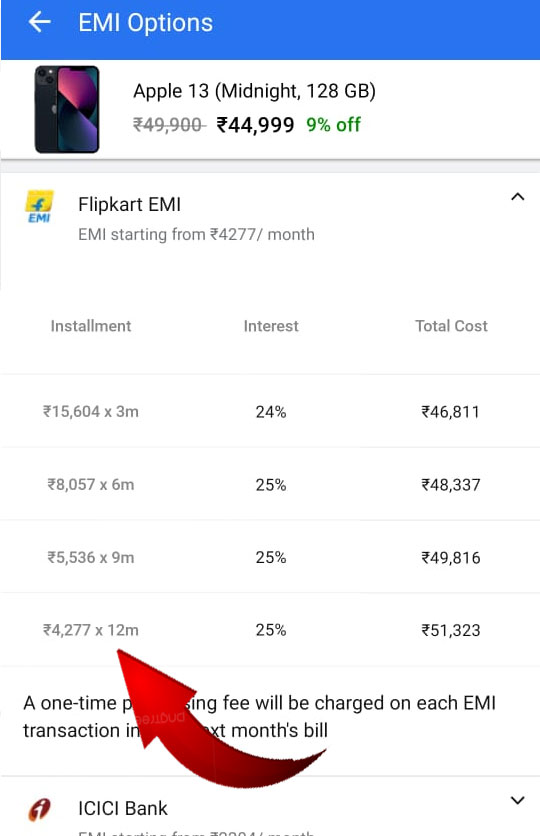

Flipkart EMI Interest Rate

The interest rate and total interest amount will be displayed on the payment page when you select your EMI plan. Typically, the interest rate is around 25%.

Flipkart EMI Charges

This EMI facility is currently available only to selected customers and for specific products with a transaction amount above ₹3,000. While Flipkart EMI charges no fees, you’ll need to pay interest and a one-time processing fee. (Source)

Frequently Asked Questions

Yes! You can cancel EMI Order on Flipkart. You’ll get Instant refunds on order cancellation or acceptance of returns.

No, check for “EMI Eligible” tag on product page.

No. You need to pay interest. However, you don’t need to pay interest if you opt for No-Cost EMI.

A penalty of 3%* of the outstanding due, levied on a monthly basis. The penalty will be calculated on the outstanding due as on the 5th of the month.

Conclusion

Flipkart EMI is a great feature for non-credit card users to buy high-value products in easy monthly installments. Always review the total payable amount, interest rates, and terms & conditions before making a purchase.

In this post, we’ve shared detailed information about this facility. If you still have questions, feel free to ask in the comments below. Found this helpful? Share it with others who might benefit too!